In today's dynamic business landscape, Environmental, Social, and Governance (ESG) considerations have transcended mere corporate responsibility initiatives to become integral pillars of sustainable growth and long-term value creation. ESG ratings serve as a powerful tool to assess a company's commitment to these principles, providing valuable insights for investors, stakeholders, and the broader community.

ESG Rating?

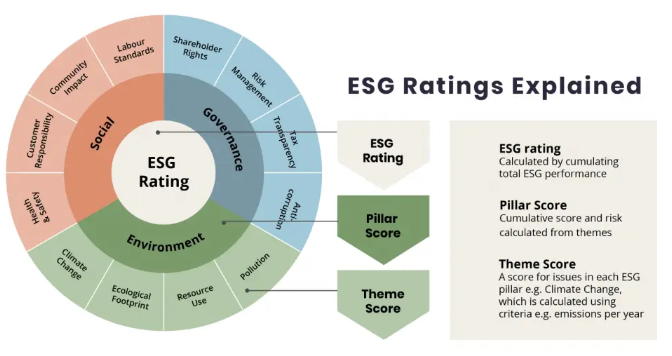

An ESG rating (Environmental, Social, and Governance Score) is a tool used to measure a company's commitment to sustainable development. It is based on three main criteria

- Environmental: This includes factors such as a company's carbon emissions, water usage, and waste management practices.

- Social: This includes factors such as a company's labor practices, human rights record, and community engagement.

- Governance: This includes factors such as a company's corporate structure, executive compensation, and board diversity.

Each of these criteria is assessed using a different set of metrics, and the scores are then aggregated into a single overall ESG rating. This score can be used to compare the sustainability performance of different companies.

The importance of ESG Scores

Compliance with government and regulatory standards: ESG ratings are not just a measure of a company's sustainability performance; they can also be used to assess a company's compliance with government and regulatory standards. For example, the European Union's Sustainable Finance Action Plan requires companies to publicly disclose ESG information in a standardized format. This is helping to make the market more transparent and is allowing investors to make more informed decisions based on sustainability criteria.

Attracting green capital: Companies with high ESG ratings are seen as being more attractive to investors who are looking for sustainable investment opportunities. This is because these companies are seen as being less risky and more likely to generate long-term value.

Enhancing brand reputation: Consumers are increasingly aware of sustainability issues and are more likely to buy products and services from companies that are seen as being socially and environmentally responsible. Companies with high ESG ratings can use this to their advantage to build a stronger brand reputation and attract more customers.

Attracting and retaining talent: Employees are also increasingly looking for companies that share their values. Companies with high ESG ratings are seen as being more attractive to talented employees and are more likely to be able to retain them for the long term.

How ESG ratings are calculated

Qualitative approach: ESG rating agencies collect data through surveys, combined with other data sources (government, press, etc.) to synthesize, analyze, calculate, and provide the most accurate results. The strength of this method is its objectivity, based solely on a list of sustainable development indicators and not influenced by personal opinions.

Quantitative approach: ESG rating agencies collect data through ESG reports, financial reports from companies. The strength of this method is time-saving but using data only from companies can reduce objectivity.

Some ESG Rating Agencies

1. Sustainalytics

Second-ranked in sustainability assessment for financial institutions. Owned by Morningstar, a leading financial services provider. Sustainalytics evaluates thousands of companies around the world, across a wide range of industries, providing deep insights into companies' sustainability performance and ESG-related risks.

Strengths

- Trusted by major investors with over $47 billion in assets under management.

- Broad coverage and high applicability, suitable for a wide range of audiences.

- Detailed ratings by industry, assessing both potential risks.

- Received numerous prestigious awards, affirming its leading position.

Weaknesses

- The method focuses on risk management, not fully assessing the overall ESG impact.

- The rating system and methodology are complex, making it difficult for users.

- Data is based on voluntary reporting, potentially containing errors and being out of date.

- The broad scope means that smaller, potentially promising companies receive less attention.

2. MSCI

The most widely used rating for Asset Management Organizations. Rates over 13,000 companies (including subsidiaries) and over 650,000 equity and fixed income securities globally. MSCI is used by 46/50 of the world's leading asset management organizations.

Strengths

- Used by many major asset management organizations (BlackRock, Credit Suisse...), with over $69 billion in assets under management.

- Broad coverage, applying AI algorithms to support in-depth data analysis.

- Provides industry-specific benchmarks, facilitating effective comparison.

- Focuses on financial materiality, suitable for investors.

Weaknesses

- Similar to Sustainalytics, the method focuses on risk management, not fully assessing the overall ESG impact.

- The complex system limits transparency for businesses and investors.

- Data is based on voluntary reporting, potentially containing errors and being out of date.

- There is no differentiation in ratings between industries.

3. CDP

A popular rating for assessing environmental criteria, used by 590 investors. Over $110 trillion in assets are rated annually, and over 200 companies, spending over $5.5 trillion annually, have required their partners to disclose environmental data in accordance with CDP ratings.

Strengths

- Recognized by many organizations and countries and owns the largest amount of business data.

- Easy to use, long-standing and versatile application, highly appreciated by investors and experts.

Weaknesses

- Focuses primarily on environmental factors (climate change, water, forest resources).

- Data is based on voluntary reporting, potentially containing errors and being out of date.

4. S&P Global

The first global sustainability rating since 1999. S&P Global, through its index division, provides a variety of ESG-focused indices, including the S&P 500 ESG Index. It is a concentration of S&P Global's solutions, combined with environmental data from Trucost to provide comprehensive insights and tools to assess ESG-related risks and opportunities for businesses.

Strengths

- High quality, highly regarded by experts.

- Integrates data and analysis from the broader S&P Global ecosystem to ensure accuracy.

- Provides a variety of ESG solutions to meet the diverse needs of investors.

Weaknesses

- Limited data access and high costs.

- The complex system with multiple data sources makes it difficult for users.

- Limited to self-reported questionnaires, focused on public companies.

- Ratings depend on the quality of the information disclosed, which may vary between companies.

5. Refinitiv

The rating with the most comprehensive ESG database in the industry. Refinitiv has a history dating back to 2002 and currently accounts for over 70% of global market capitalization.The rating collects and analyzes data from over 9,000 companies worldwide, including over 450 different ESG metrics. This data includes information on carbon emissions, water usage, innovation, workforce diversity, and provides insights into companies' sustainability performance.

Strengths

- The most comprehensive ESG database in the industry, covering over 70% of global market capitalization.

- Detailed analysis of over 9,000 companies worldwide with over 450 ESG metrics.

- Provides a comprehensive view of a company's sustainability performance.

- Transparent methodology, enhancing investor confidence.

Weaknesses

- The large amount of data makes it difficult for non-expert users.

- Potential delays in data aggregation.

- Focus on quantitative data, not fully assessing qualitative factors.

- Metrics change over time due to adjustments, making comparisons difficult.

ESG ratings are not only a measure of current sustainability, but also a foundation for businesses to move towards a prosperous future and contribute to building a healthy and responsible business environment.

Let's join hands to protect the environment and mitigate climate change!

GIANT BARB SCIENCE AND ENVIRONMENT JOINT STOCK COMPANY

📞 Hotline: +84 995 206 666

✉️ Email: info@giantbarb.com

🏢 Headquarter: No.07 Ton That Thuyet, Dich Vong Hau ward, Cau Giay district, Ha Noi