Leading the Green Energy revolution

Tesla, widely recognized as a pioneer in the electric vehicle (EV) market, has successfully positioned itself as more than just an automaker. The company’s revenue streams are diverse, encompassing vehicle sales, energy solutions, a global charging network, and regulatory credits.

Vehicle Sales: Tesla’s core revenue stream

Tesla’s most significant source of income comes from selling electric vehicles. As a leader in EV production, Tesla has capitalized on growing demand for environmentally friendly transportation. Its diverse lineup includes the popular Model 3, Model Y, Model S, and Model X, alongside newer ventures such as the Cybertruck and Tesla Semi.

Tesla wrapped up 2024 with another year of declining profits, reporting $8.4 billion in net income attributable to common stockholders—a 23% drop from 2023 and a steep 40% decline from its 2022 record of $14.1 billion.

Energy generation and Storage solutions: Expanding beyond EVs

Tesla’s energy generation and storage segment, though smaller than its vehicle division, plays a crucial role in diversifying the company’s revenue. According to Investopedia, this segment accounted for 6.2% of Tesla’s total revenue in recent years.

This business unit includes products such as Tesla Powerwall, a home battery system that stores solar energy, and Powerpack and Megapack systems designed for large-scale commercial use. Tesla also installs solar panels and solar roofs, allowing homeowners to generate clean energy and reduce their reliance on traditional power grids. These innovations align with Tesla’s broader mission of accelerating the global transition to sustainable energy.

Supercharging Tesla’s global footprint

Tesla’s Supercharger Network is another vital component of its business model, enabling the company to maintain leadership in EV infrastructure. By providing convenient, high-speed charging stations across the U.S. and other countries, Tesla enhances the appeal of its vehicles and strengthens its sustainability mission.

In 2024, Tesla expanded its Supercharger network significantly, adding over 10,000 new charging stalls—a 19% increase year-over-year—bringing the global total to more than 65,000 stalls. This expansion aims to alleviate “range anxiety” and encourage EV adoption by offering faster, more accessible charging solutions.

The company also introduced its advanced V4 Supercharger, capable of delivering up to 500 kW for passenger vehicles and 1.2 MW for Tesla Semis, marking a technological leap in charging efficiency. Furthermore, Tesla opened its North American charging network to more automakers, encouraging broader industry adoption of the North American Charging Standard (NACS).

Selling Regulatory Credits: A Quiet but Profitable Lifeline

While Tesla’s vehicle and energy sales dominate headlines, a lesser-known but highly profitable revenue stream comes from selling regulatory credits, often referred to as carbon credits. These credits are tradable certificates that allow automakers to offset their carbon emissions, meeting regulatory requirements in markets with stringent environmental standards.

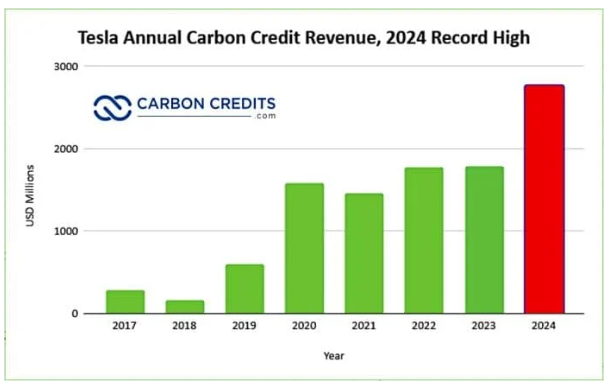

Tesla, as a company that produces zero-emission EVs, earns surplus carbon credits, which it can sell to other automakers that still rely heavily on gasoline-powered vehicles. This strategy has proven lucrative. In 2024, Tesla’s carbon credit revenue surged to $2.76 billion, a 54% increase from $1.79 billion in 2023. Notably, Tesla generated $692 million from selling these credits in Q4 alone, representing nearly 30% of its quarterly net income of $2.33 billion.

Source: Carbon Credits

Tesla’s leadership in carbon credit sales underscores its financial resilience, especially as it navigates the challenges posed by declining vehicle margins. Additionally, Tesla’s EV fleet has prevented more than 20 million metric tons of CO₂ emissions from entering the atmosphere, with 5 million metric tons avoided in 2023 alone, demonstrating the company’s tangible impact on global sustainability.

Tesla’s Future Growth

Tesla’s diversified revenue model – with a focus on EV sales, energy products, a global charging network, and carbon credits – has made the company a major player in renewable energy. Going forward, Tesla’s sustained success will depend on its ability to maintain its technological leadership, expand its energy grid and Superchargers, and adapt to market fluctuations.

GIANT BARB SCIENCE AND ENVIRONMENT JOINT STOCK COMPANY

📞 Hotline: +84 915 452 358

✉️ Email: info@giantbarb.com

🏢 Headquarter: No. 245 Quan Hoa, Cau Giay district, Hanoi